The cryptocurrency market has always been a source of intrigue and speculation throughout history. Bitcoin remains the unchallenged leader, influencing market trends and increasing interest worldwide, with the Bitcoin Golden Surge driving even more attention as we approach 2024. This is just one of its many highlights. The price trajectory of Bitcoin is generating excitement as 2024 winds down. Recent technical signs, particularly the formation of a “Golden Cross,” have inspired experts and fans to feel optimistic about the market. Is this the signal that Bitcoin must surpass its all-time high? Let’s investigate the variables that are contributing to this presumption.

Bitcoin Bull Run Accelerates

Following a week that was the greatest for the currency in a month, the bull run and the price of Bitcoin have reached their original levels, signaling a potential Bitcoin Golden Surge. Even though the leading cryptocurrency began the week with tranquility and maintained proximity to $63,000, it significantly increased velocity throughout the middle of the week and hit $69,000 on Friday. A fresh discovery on the chain demonstrates that there has been an increase in the amount of traffic on the Bitcoin network over the last several weeks. Bitcoin was the source of this helpful knowledge. While this new feature may have contributed to the recent price increase, nobody knows how it will affect the most popular currency.

Golden Cross Targets $73K

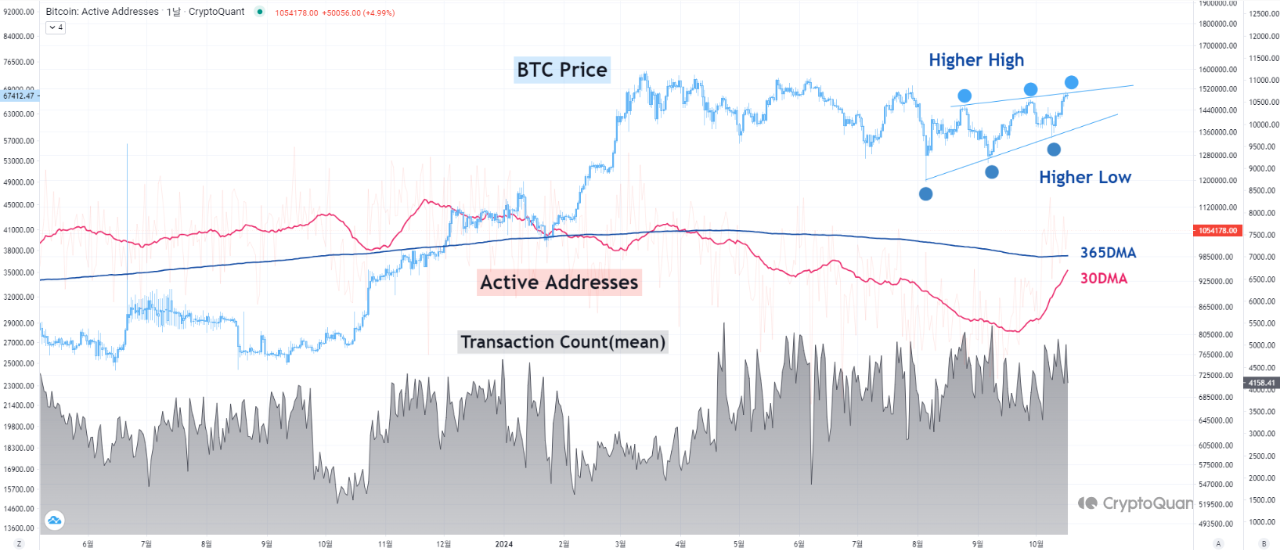

An analyst using the pseudonym Yonsei_dent recently suggested that the price of Bitcoin may be forming an upward structure in a Quicktake post on the CryptoQuant platform. The basis for this optimistic forecast is the growth rate of active addresses, or the number of distinct addresses exhibiting noteworthy activity on the Bitcoin network. Increasing these active addresses provides information about general market trends, investor sentiment or behavior, and network activity. So, it might be helpful to use moving averages (MAs) from different periods to see how these unique addresses are growing and to look at current price trends. The CryptoQuant analyst used a 30-day moving average (30DMA) and a 365-day moving average (365DMA) in their most recent analysis to capture the growth momentum of the Bitcoin active addresses.

We have experienced the 30-day moving average. There has been a significant increase in the last month, and it is getting close to the 365DMA. The chart below illustrates this trend. Yonsei_dent states that if the 30DMA eventually reaches the 365DMA and crosses it to the upside (forming a golden cross), the price of Bitcoin may undergo a positive shift in bullish momentum. A bullish chart with a relatively short-term moving average crossing above a long-term moving average is known as a “golden cross” in the context of cryptocurrency. A golden cross usually signals the beginning or continuation of a long-term bull market. This suggests that Bitcoin’s price may be poised for a surge toward its record high of $73,737.

Bitcoin Upward Trend

Bitcoin is forming an upward shape, suggesting a positive trend. The cryptocurrency has broken critical resistance levels recently and maintained a steady rise. Rising lows and highs are a technical pattern that generally anticipates price rallies. In this phase, individual and institutional investors pay more attention to Bitcoin, fueling its ascent. Network activity, institutional participation, and market optimism drive this increased trend. The Golden Cross and other technical indications boost Bitcoin price optimism. Inflation worries and the move toward decentralized assets further bolster Bitcoin’s value as a store of wealth. Many experts predict Bitcoin might reach new price highs once this structure settles.

Also Read: BlackRock Bitcoin Shift Boosts Institutional Interest in Crypto

Summary

Some believe that Bitcoin, the most valuable cryptocurrency, has the potential to surpass its all-time high. Scientific indicators, such as a ‘Golden Cross,’ point to a Bitcoin Golden Surge, suggesting its value could skyrocket. After a favorable week, Bitcoin’s price increased from $63,000 to $69,000 because the network was busy. Analysts say a rise in live Bitcoin addresses points to a bullish phase. The Golden Cross happens when a short-term moving average exceeds a long-term one. This is often a sign of a long-term rise. Many people think Bitcoin will hit $73,737 because big investors are interested, and the market is optimistic. Worries about inflation and a desire for uncontrolled investments are driving this trend.